How to Close Pay Later Account in Flipkart

If you’re a regular Flipkart user and have opted for the Flipkart Pay Later option, you may be considering How to Close Pay Later Account in Flipkart. This payment method allows users to shop on Flipkart and pay their bills later, a feature particularly useful for those who prefer monthly payments. However, if you no longer wish to use this service or are concerned about your CIBIL score or other reasons, deactivating this account is straightforward.

In this article, we will guide you through How to Close Pay Later Account in Flipkart in 5 easy steps. Let’s take a detailed look at each stage.

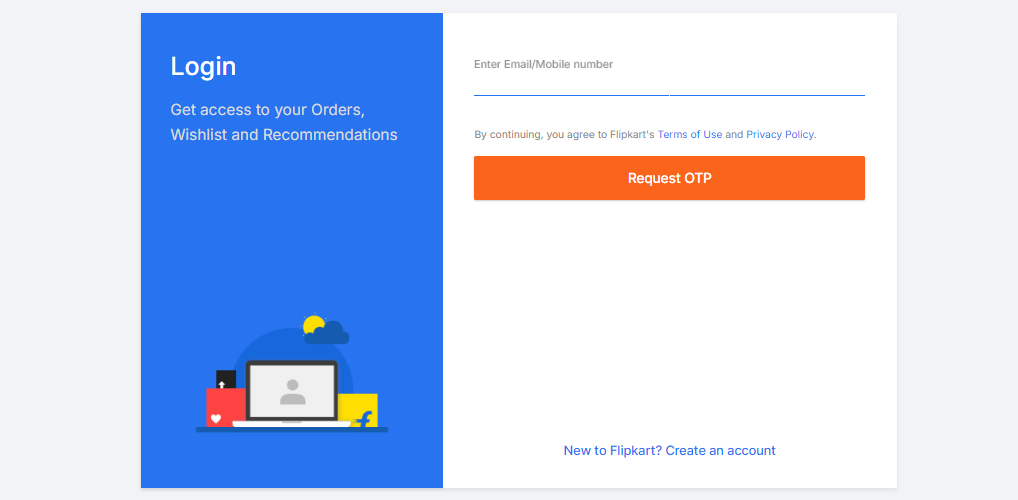

Step 1: Log in to Your Flipkart Account

To begin the process of closing your Flipkart Pay Later account, you need to first log in to your Flipkart account. Simply use the same email/phone number and password combination you initially used when creating your account.

Once logged in, make sure that your account has no outstanding balances to prevent any issues with the account closure. Clearing dues is crucial to ensure a smooth deactivation process.

Step 2: Navigate to Flipkart Help Center

Once you’ve logged in, the next step is to visit the Flipkart Help Center. You can easily access this by clicking on your account icon, usually located in the upper-right corner of the screen.

Once inside, navigate to the Help Center section, which is where you’ll find a list of support options available for different services. This is where you’ll go to resolve issues related to your Flipkart Pay Later account.

Step 3: Locate the ‘Chat’ or ‘Callback’ Option

Once you’ve reached the Help Center, the next task is to locate the chat or callback option for further assistance. Look for the “I want help with other issues” option. After clicking this, select “others” from the available list, and you will be directed to additional options.

Once you tap on “others” again in the dropdown, the callback option will appear. This will allow you to request a callback from a Flipkart representative.

Step 4: Request a Callback

Upon selecting the callback option, you’ll receive a call from Flipkart customer service within 5 to 10 minutes. When speaking to the customer support team, politely ask them to assist you in permanently closing your Flipkart Pay Later account.

Be specific when you request the closure – ensure you mention that you want the account closed permanently rather than simply deactivating it temporarily. This is important to prevent future reactivations or complications.

Step 5: Account Closure and Timeline

After requesting the closure through customer support, the process to close your Flipkart Pay Later account will be initiated. It can take up to 30 days for the account to be officially closed.

This closure will be updated on your CIBIL report in the form of a closed account status, which usually takes about 2-3 months to reflect. Ensure that you keep an eye on your CIBIL report to confirm the successful closure of your Flipkart Pay Later account.

Related Post

Alternative Method: Email Request for Closure

If you prefer not to use the Help Center, you can also send an email to Flipkart customer service requesting the closure of your Pay Later account. Use your registered email and address the email to Cs@flipkart.com.

Ensure that your email subject line clearly indicates the closure request. For instance, you can use the subject line: “Flipkart Pay Later Closure Request.” Here’s an example email format you can follow:

Subject: Flipkart Pay Later Closure Request

To: Cs@flipkart.com

Dear Flipkart Team,

I am writing to request the permanent closure of my Flipkart Pay Later account associated with the email ID [your email]. Kindly confirm the successful deactivation and account closure at your earliest convenience.

Thank you,

[Your Name]

[Your Registered Phone Number]

Once you send this email, the support team will get in touch with you via your registered phone number or email to confirm your request. However, keep in mind that this method may take longer, and it’s always best to use the Help Center for quicker results.

Involving the RBI Ombudsman

If you face any issues with Flipkart not responding to your requests or delays in account closure, you can approach the RBI Ombudsman. The Reserve Bank of India is responsible for overseeing financial services, and you can file a complaint if you believe your issue is unresolved.

Ensure that you have all the necessary documentation and evidence before contacting the Ombudsman, such as email communications with Flipkart or records of the callback request. You can submit your issue directly to them, explaining your problem and the steps you’ve already taken to resolve it.

Important Considerations Before Closing Your Flipkart Pay Later Account

Before proceeding with the closure of your Flipkart Pay Later account, there are a few important points to keep in mind:

1. Clear Outstanding Payments

Ensure that all outstanding balances are cleared before initiating the closure process. This will prevent any unnecessary delays or issues when attempting to close the account.

2. Request a No Objection Certificate (NOC)

After the closure process is complete, you will receive a No Objection Certificate (NOC) from Flipkart’s lending provider, IDFC First Bank, within 2-3 weeks. If you don’t receive the NOC, follow up with the Flipkart Help Center to request it.

3. Irreversible Closure

Remember that closing your Flipkart Pay Later account is a permanent decision. Once the account is closed, you will not have the option to reapply for the Flipkart Pay Later service again in the future.

Conclusion

Closing your Flipkart Pay Later account may seem like a complex process, but by following these steps, you can ensure a smooth and hassle-free experience. Whether you prefer contacting the Help Center or sending an email, make sure to follow up until the closure is confirmed.

For more information and assistance on managing your Flipkart account, always refer to the official Flipkart Help Center for reliable and up-to-date advice.

FAQs of How to Close Pay Later Account in Flipkart:

1. How do I check if I have any outstanding balance on my Flipkart Pay Later account before closing it?

To check if you have any outstanding balance on your Flipkart Pay Later account, log in to your Flipkart account and navigate to the My Account section. Under the Flipkart Pay Later option, you’ll be able to see any unpaid dues. Make sure to clear all outstanding payments before proceeding with the closure.

2. Can I reopen my Flipkart Pay Later account after closing it?

No, once you close your Flipkart Pay Later account, the closure is permanent. You will not have the option to reapply for the Flipkart Pay Later service in the future, so consider this carefully before requesting closure.

3. How long does it take for Flipkart to close my Pay Later account?

After requesting the closure of your Flipkart Pay Later account, it typically takes about 30 days for the process to be completed. The closure will reflect on your CIBIL report within 2-3 months as a closed account.

4. What should I do if I don’t receive a response from Flipkart after requesting the closure?

If you don’t receive a response from Flipkart within the expected time, you can follow up by contacting the Flipkart Help Center again. If the issue persists, you may escalate the matter to the RBI Ombudsman, who handles complaints related to financial services.

5. Will closing my Flipkart Pay Later account affect my CIBIL score?

Closing your Flipkart Pay Later account can have a minor effect on your CIBIL score, as it reduces your credit line. However, if all payments are up to date and there are no overdue amounts, the impact should be minimal. Always ensure you clear any outstanding dues before requesting the account closure.